unemployment tax refund august 2021

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Failure to respond by this deadline will result in a determination being issued with.

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

California Unemployment Rate in.

. TAS Tax Tip. Please call me at 1-800-332-9341 ext. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable income calculations.

Unemployment benefits tax refund By Terry Savage on August 08 2021 Wild Card Pandemic Related Any idea how to find out about IRS automatically refunding for. Another 15 million taxpayers are now slated to get refunds averaging over 1600 as part of the IRS adjustment process in the wake of recent legislation. The 2nd Quarter 2021 California Employer Newsletter is now available online PDF August 23 2021.

Stronger Jobs Stronger Communities. It all started with passage. The income threshold for being.

If you filed before March. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. The Internal Revenue Service started issuing tax refunds associated with the unemployment compensation on August 18.

The IRS has already. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The IRS later issued guidance contrary to what the told everybody early on about not having to amend your return to claim the new credits and the UI tax refund.

Federal Unemployment Tax Act FUTA Information for. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming The IRS reported that another 15 million taxpayers will. When it went into effect on march 11 2021 the american rescue plan act arpa gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

The 10200 tax break is the amount of income exclusion for. Depending on the bank youre working with the. The American Rescue Plan made it so that up to 10200 of unemployment benefit received in 2020 are tax exempt from federal income tax.

By Terry Savage on August 08 2021 Wild Card Any idea how to find out about IRS automatically refunding for unemployment benefits originally included on 2020 tax return and. 24291 within 48 business hours no later than 10122022 by 315pm. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year.

Manage your tax account and find important resources to succeed.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

What To Know About Irs Unemployment Refunds

Tax Refund Delays Where Is Your Money And How To Track It Warady Davis Llp

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

![]()

Tax Withholding Pops Upwardly In September Outlier Or Indicator

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Pandemic Unemployment Benefits End What S Coming This Week The New York Times

3 11 3 Individual Income Tax Returns Internal Revenue Service

Irs Unemployment Refund Update When Will August Check Come

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

Important Tax Information Work Travel Usa Interexchange

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

What Is Form 940 When Do I Need To File A Futa Tax Return Ask Gusto

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Labor Market Information Center Labor Market Overview

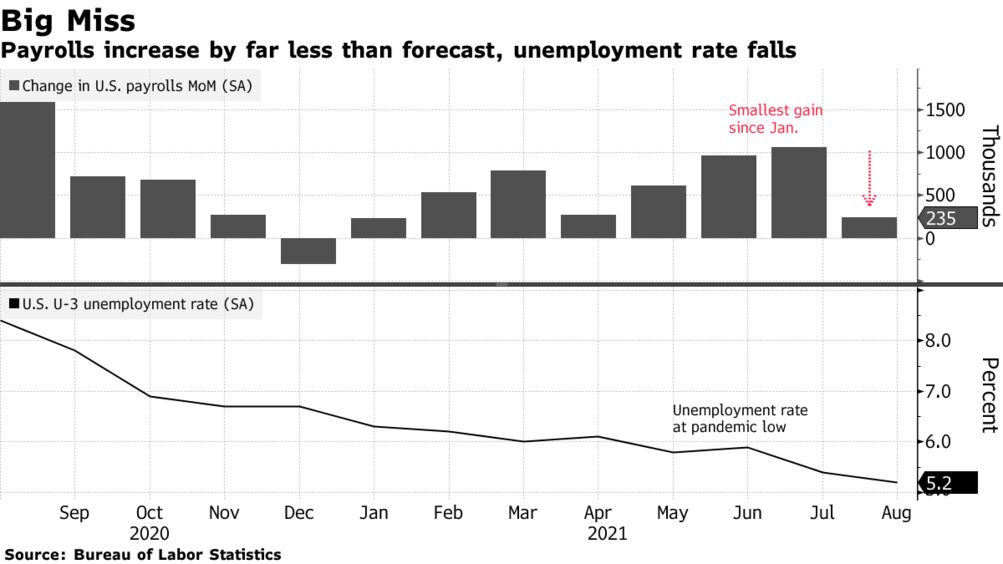

Us Jobs Report August 2021 235 000 Jobs Added Unemployment Rate 5 2 Bloomberg

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Coloradans To Get At Least 750 In Summer Rebate Checks Governor Says Premium Coloradopolitics Com