non ad valorem tax florida

Ad Valorem TaxesNon-Ad Valorem Taxes. Florida real estate taxes often include different types of taxes and assessments.

Non Ad Valorem Fire Assessment Frequently Asked Questions Press Releases City Of Ocala

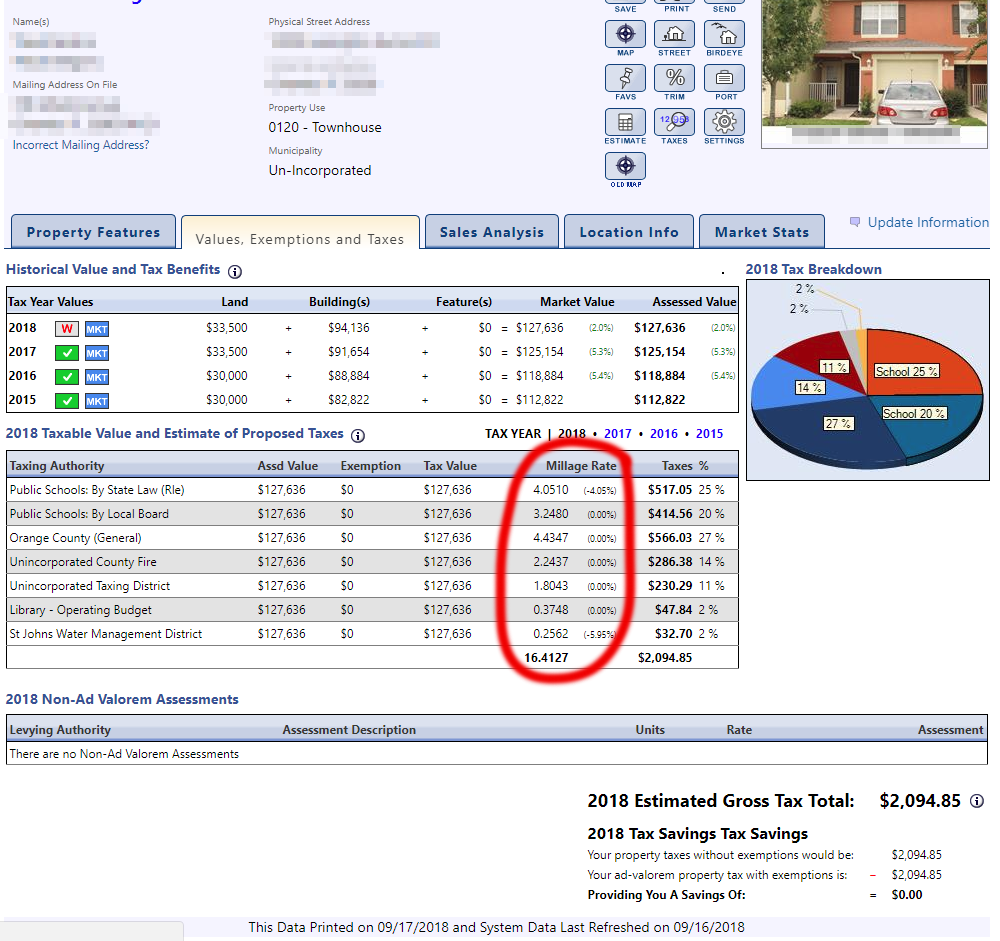

Ad Valorem taxes are based on the property value less any exemptions granted multiplied by the applicable millage rate.

. What is a NON-AD VALOREM Assessment. They may be expenses for other items though like rental property or businesses. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation.

Non-ad valorem is by definition different from a value-based prop-erty. To pay the principal of and interest on any general obligation. PDF 88 KB XLS 82 KB DR-520A.

The Palm Bay case and FS. 201 Excise Tax on Documents. The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida Department of Revenue and Florida Statutes.

An ad valorem tax levied by the board for operating purposes exclusive of debt service on bonds shall not exceed 3 mills except that a district authorized by a local general-purpose government to exercise one or more powers specified in s. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments. Non Ad Valorem Assessment is a charge or a fee not a tax to cover costs associated with providing specific services or benefits to a property.

In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Non Ad Valorem Tax Florida at Tax. The roll must be prepared and adopted according to Florida Statutes.

TAX COLLECTIONS SALES AND LIENS. Baytree Montecito Viera East Community Development Districts. Non-ad-valorem assessments are based on the improvement or service cost allocated to a property and are levied on a benefit unit basis rather than on value.

194 Administrative and Judicial Review of Property Taxes. They are NOT considered property taxes for Schedule A although some exceptions may apply see comments below. FLORIDA PROPERTY TAX CALENDAR TYPICAL YEAR DOR DEPARTMENT OF REVENUE PA PROPERTY APPRAISER TC TAX COLLECTOR VAB VALUE ADJUSTMENT BOARD MONTH DATE AD VALOREM TAXES NON-AD VALOREM ASSESSMENTS BEFORE JANUARY 1 Local government advertises and adopts resolution to include assessment fee with ad valorem tax.

The tax roll describes each non-ad valorem assessment included on the property tax notice. City of Palm Bay. 197 Tax Collections Sales and Liens.

In City of Boca Raton v. There are different types of non-ad valorem assessments that can appear on your TRIM Notice. To obtain a list of Non-ad valorem assessments for a particular parcel.

For questions concerning current capital assessment balance amounts call 9417431914. Non-ad valorem fees can become a lien against a property whether homesteaded or not. 200 Determination of Millage.

When purchasing a property with a non-ad valorem be aware that the. THE 2021 FLORIDA STATUTES. 195 Property Assessment Administration and Finance.

The 2021 Florida Statutes. Waste collection and disposal sewer lighting fire protection or ambulance services. These charges are collected beginning November 1 each year and become delinquent April 1.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. 190012 2 may levy an additional 2 mills for operating purposes exclusive of debt service on bonds. Should a non-ad valorem assessment for code enforcement costs be upheld as lawful it could result in the indirect creation of a super-priority code enforcement lien since taxes and assessments are.

A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a. Steele Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 The Monroe County Tax Collectors Office is. You have asked that this discussion be limited to non-ad valorem taxes.

3 Non-ad valorem assessments are defined as only those assessments which are not based upon millage and which can become a lien against a homestead. Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. The Non- Ad valorem tax rolls are prepared by local governments and certified to the Tax Collectors Office for collection.

The Non-Ad Valorem office is responsible for preparing a certified Non-Ad Valorem Assessment Roll for special assessment districts under supervision of the Board of County Commissioners. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Value-based ad valorem assessments.

1 AD VALOREM TAXES. Port Charlotte FL 33948. The dollar amount of the pay-off is listed under the Current Balance column.

Nonad valorem assessment period for which services are rendered and assessed on nov 2021 tax bill belmont lakes community development district october 1 2021 through september 30 2022 botaniko community development. These charges are collected beginning November 1 each year. The term non-ad valorem denotes something other than levies from cost-based charges and regulatory-based fees or exactions.

1 AD VALOREM TAXES. CHAPTER AND TITLE. TAXATION AND FINANCE.

CUSTODIAN OF PUBLIC RECORDS. Copies of the non-ad valorem tax roll and summary report are due December 15. Impact fees and user charges.

The ad valorem tax roll consists of real estate taxes tangible personal property taxes and railroad taxes. In Nassau County all non-ad valorem special assessments are a flat rate with the exception of SAISSA which uses a value-based calculation. Non-ad valorem means special assessments and service charges not based upon the value of the property and millage.

Each special assessment board calculates the amount to be assessed and provides the Tax Collector with a non-ad valorem assessment roll. An elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct operate and maintain assessable improvements. Non-ad valorem assessments collected within their own area include.

The non ad valorem assessment is measured based on a unit of measure determined by each levying. Click here for Record Searches. These amounts are added to the tax roll and are billed in the total.

1 As used in this section. 162 could thus lead to a constitutional challenge against the collection of nuisance abatement costs on tax bills. Is in accordance with the rules and regulations of the Florida Department of Revenue and Florida Statutes.

Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101 Key West FL 33040 305 295-5000. Barefoot Bay Recreation District. A Non-Ad Valorem Assessment is a legal financing mechanism or method wherein the County establishes a special district to allow a group of citizens to fund a desired improvement such as utilities or roads by majority consensus 51 of the approval of the property owners contained in the assessment area.

The Supreme Court of Florida has recently recognized that a special assessment is not a tax.

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Real Estate Property Tax Constitutional Tax Collector

Are Non Ad Valorem Taxes Deductible For Income Taxes

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

Understanding Your Tax Notice Highlands County Tax Collector

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Real Estate Taxes City Of Palm Coast Florida

A Guide To Your Property Tax Bill Alachua County Tax Collector

Tax News And Information Lower Your Property Taxes With Property Tax Professionals

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

Broward County Property Taxes What You May Not Know

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Understanding Your Tax Bill Seminole County Tax Collector

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law